Kirchner Impact Foundation – 10 Years of Impact

Our Founder and CEO, Bud Kirchner, will often reference a Mark Twain quote when he describes our collective work and experience: A person who carries a cat by the tail learns a lesson they can learn in no other way. The image the quote invokes is so stunning that it’s impossible to forget. But it’s…

Our Founder and CEO, Bud Kirchner, will often reference a Mark Twain quote when he describes our collective work and experience: A person who carries a cat by the tail learns a lesson they can learn in no other way.

The image the quote invokes is so stunning that it’s impossible to forget. But it’s also highly effective in making a point: we learn from our mistakes, and our scars. Said another way, there is no shortcut to experience. Having been in business as a group for over 40 years, needless to say, our experience speaks for itself.

In 2013, the team at Kirchner Group put our heads together around the problem of making small dollar impact investments in places where they’re needed most.

We started with a series of questions:

- As food and agriculture experts, how do we sustainably feed a growing population amidst a climate crisis?

- How can we leverage young people and decades of experience to find and fund smarter, more sustainable products and services in remote, under-resourced parts of the world?

- How do we create a more efficient capital allocation model that is diverse and inclusive and creates pathways for career advancement?

- How can we harness the power of enterprise to solve these challenges?

The idea was to create an experiential, learning-by-doing environment (without cats) in a timeline far shorter than most training programs and methods can offer. By harnessing the power and energy of young people and their ability to network, research, and analyze, to scour the world for impactful businesses, we could create a unique capital allocation training program, with just a few caveats:

- It has to be real. A real company, a real transaction, real negotiation and real investment dollars.

- The team (Fellows) must have full discretion over the investment decision. This creates a feeling of ownership and raises the stakes for the investment teams.

And as a result, the Kirchner Impact Foundation was created to evolve the concept and begin the experiment.

Ten years later, what have we achieved and what are we still striving for?

- Through our training programs, the Kirchner Fellows have deployed $350,000 in investment capital into early-stage companies, facilitating critical catalytic capital for company

growth and regional / community economic development - As a result of the capital deployed, the Foundation maintains relationships with a portfolio of companies that KIF continues to support with investment capital, technical assistance, introductions and more

- We have developed a deal flow database with over 1,500 early-stage early-stage companies across North and Latin America

- Through our deal pipelines, pitch events, and collective network, our team has provided 2,000+ hours of pro-bono consulting and technical assistance to early-stage entrepreneurs

- We have brought together over 250 entrepreneurial teams in the last four years to pitch their projects/companies for cash and in-kind prizes

- 67% of portfolio company founders identify as BIPOC/Latin

- 50% of portfolio company founders identify as women

- Over 1,000 individuals trained via the Kirchner Investment Academy, with a 99% satisfaction rate

- 53 Investment Committee Fellows trained

- Gender parity of program alumni (51% identify as women)

- 72% of program alumni identify as BIPOC/Latin

- 15 countries represented

- $415+ million allocated (directly and indirectly) by program alumni

- Program alumni have joined leading firms such as Cargill Ventures, Goldman Sachs, Microsoft, Bridgespan Group, and Coca-Cola as well as gone on to start their own companies

What does the future look like for the Kirchner Impact Foundation?

- Doubling down on our multi-pronged approach of providing training to university students as the next generation of investors and being a mission-oriented, value-add investor by providing capital, technical assistance and beyond;

- Strengthening and deepening our impact in Mexico and the HBCU community;

- Offering accessible training programs to a variety of audiences in the impact capital allocation space (investors, entrepreneurs, technical assistance providers, etc.).

We need your help to do this.

Support the next ten years of impact and help us create the next generation of thoughtful capital allocators and entrepreneurs solving the most intractable problems. Contribute today!

Learn more about the program

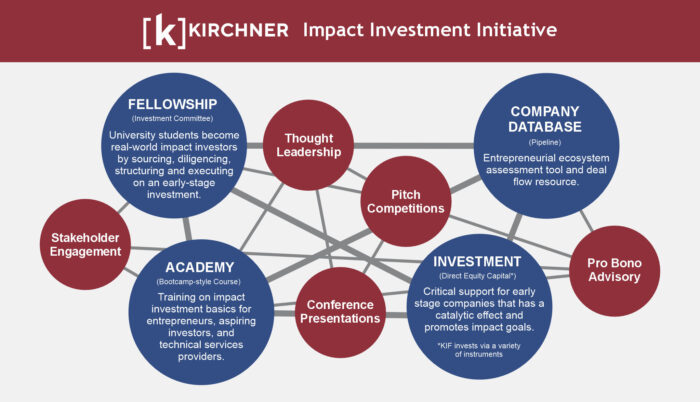

KIF has a 10-year history of delivering programs that help build and strengthen entrepreneurial ecosystems, with a special sector focus on food and agriculture and the enabling infrastructure. The Kirchner Impact Investment Initiative includes: